Amidst choppy markets, with FPIs selling at regular intervals and DIIs mostly in buying mode, investors may be better of getting into pockets where volatility is lower and there exists some valuation comfort. Large-caps perfectly fit this requirement for investors with moderate risk appetites.

At present, large-caps are reasonably valued and could also remain relatively insulated in case of stronger corrections.

In general, across market cycles, large-caps must form a critical part of the portfolio holdings in the case of investors with moderate to medium risk appetites.

In this regard, investors can consider the Aditya Birla Sun Life Frontline Equity fund (ABSL Frontline Equity) for long-term goals that are 7-10 years away.

The 22-year-old fund has been on a robust revival mode over the past 2-3 years after a period of prolonged relative underperformance.

Over longer timeframes, the scheme tends to deliver above-average returns that usually exceed the benchmark comfortably.

Taking the SIP route for taking exposure to the fund would help average costs and reduce portfolio volatility.

Returning to the fast track

ABSL Frontline Equity was among the top quartile performers for the better part of the first 10-15 years of its operations. Then, after SEBI’s recategorisation and the relatively narrowly led markets over the second half of the previous decade led to the fund getting into the slow lane. However, from mid-2022, the fund’s performance has been on the mend.

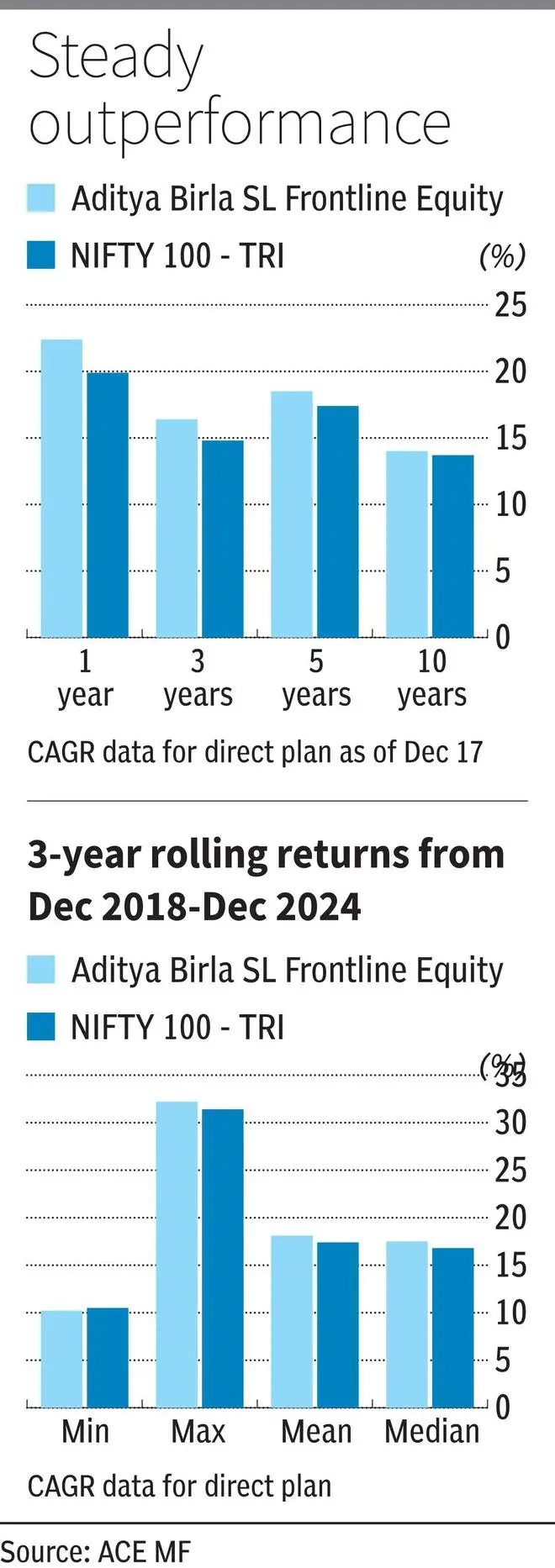

Over the past 1-year, 3-year, 5-year and 10-year timeframes, the fund has delivered 22.4 per cent, 16.4 per cent, 18.5 per cent and 14 per cent, respectively on a point-to-point basis. The scheme outperformed its benchmark, Nifty 100 TRI, by 50-300 basis points across time periods.

When three-year rolling returns over the past the six-year period (December 2018 to December 2024) are considered, the fund has delivered mean returns of 18.1 per cent. For comparison, the Nifty 100 TRI delivered average returns of 17.4 per cent, which is quite reasonable in a market cap segment where beating the benchmark is quite challenging.

Also, in the period mentioned above, on a 3-year rolling basis, the scheme has beaten its benchmark Nifty 100 TRI nearly 69 per cent of the time. It has delivered more than 12 per cent over 96 per cent of the time during this period and more than 15 per cent nearly 82 per cent of the time.

The fund’s SIP returns (XIRR) over the past 7 years are healthy at 18.4 per cent. An SIP in the Nifty 100 TRI would have returned 17.4 per cent over the same period.

All return figures pertain to the direct plan of the fund.

ABSL Frontline Equity fund has an upside capture ratio of 99.4, indicating that its NAV rises marginally less than the benchmark during rallies. But more importantly, it has a downside capture ratio of just 87.9, suggesting that the scheme’s NAV falls much less than the Nifty 100 TRI during corrections. A score of 100 indicates that a fund performs in line with its benchmark. These observations are based on data from December 2021-December 2024.

Steady portfolio

In keeping with its mandate of having a large-cap portfolio, the fund holds 85 per cent (give or take a couple of percentage points) of its holdings in such stocks. However, ABSL Frontline Equity also holds 7-10 per cent of its portfolio in mid-caps, to derive a kicker to the overall returns. The cash position has been to the tune of 4-5 per cent across market cycles.

Though the key players in any sector are preferred, the fund has managed to zero in on the winners and increased weightage of those firms in the portfolio. So, ICICI Bank, HCL Technologies, Mahindra & Mahindra, Tata Motors, Sun Pharma and Cipla were preferred a bit more over others in the portfolio. This selection helped the fund derive better returns even if any sector wasn’t particularly doing well at a larger level.

In terms of sectors held, banks and software companies always figure on top of the fund’s holdings across timeframes. This shows ABSL Frontline Equity’s focus on relative valuations. Depending on the traction in segments, automobiles, pharmaceuticals, construction and petroleum products have figured prominently in the portfolio at various points in time.

The fund generally held 50-plus stocks in its portfolio. The recent portfolio shows 80-plus stocks. Exposure to individual stocks is less than 5 per cent barring the top few holdings, and is diffused.

Overall, ABSL Frontline Equity is well-suited for investors looking to save for financial targets that are due a decade away.

Those looking for the long-term of at least seven-plus years can consider the scheme via the systematic investment route.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.