Indian equity markets have been on a rollercoaster ride over the last four months. A host of factors triggered volatility and dampened investor sentiments including tepid second-quarter (Q2) earnings, relentless sell-off by foreign institutional investors, rising valuations of domestic mid and small-cap stocks alongside escalating geopolitical tensions.

Investors with a medium-risk profile, who are concerned about the current market volatility, can consider investing in balanced mutual fund schemes that have a mix of equity and debt in their portfolio.

Balanced funds can serve you the purpose of limiting your portfolio risk in equity market downturns. Aggressive hybrid funds is one such category that invests between 65 and 80 per cent in equity with the rest being parked in debt assets. The higher allocation to equity can help deliver good returns during equity market rallies, while the debt exposure helps cap losses amid market downturns.

Aggressive hybrid funds follow a static asset allocation of maintaining their equity exposure between 65 and 80 per cent while the balanced advantage funds, another hybrid category, has the leeway to move between equity and debt without any restriction. These funds maintain a well-rounded equity component, with exposure to large, mid, and small-caps, while the debt portion generates yields through a mix of credit, interest rate, and duration strategies.

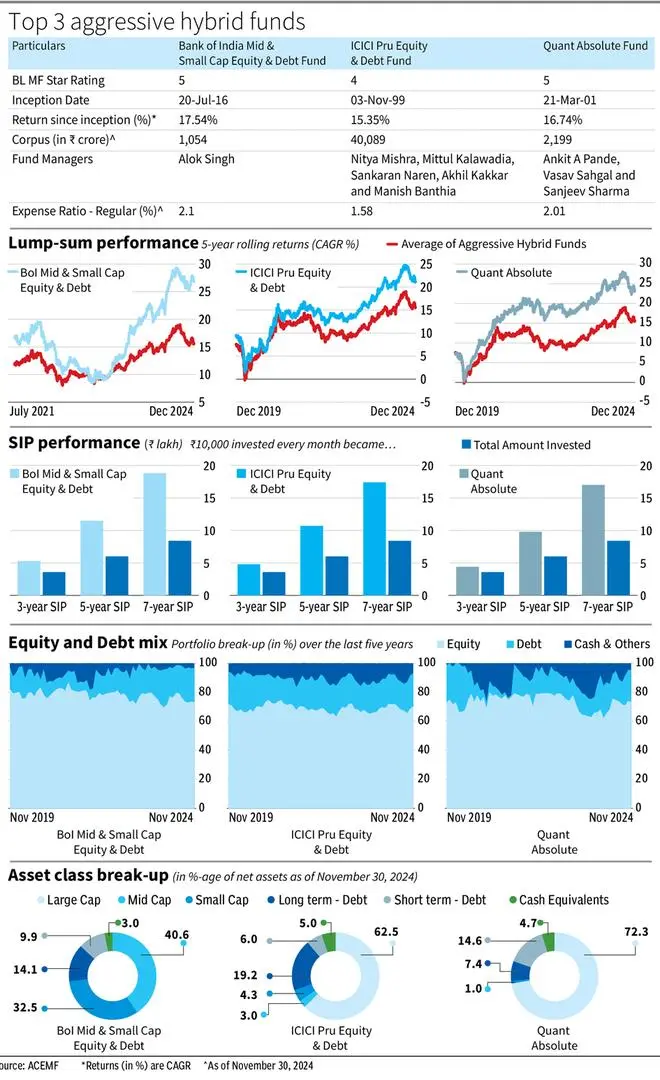

Here are the three aggressive hybrid funds short-listed from among those rated four and five star by bl.portfolio Star Track MF Ratings.

Bank of India Mid & Small Cap Equity & Debt Fund

Bank of India Mid & Small Cap Equity & Debt Fund has been the top fund among the aggressive hybrid category in the last 5-year timeframe with the largest allocation to small and mid-cap companies. Although, investing higher into mid and small-cap stocks can result in delivering comparatively better returns, it also entails relatively higher risk.

Performance as measured by the five-year rolling return calculated from the last 10-year data shows that the fund delivered a compounding annualised return of 17 per cent, while the Nifty 50 – TRI posted 13.4 per cent. Meanwhile, the aggressive hybrid fund category gave 12 per cent during the period.

The fund has a higher degree of risk in the category (17.3 as against the category average of 14.9), as measured by the annualised standard deviation calculated for the last five-years. Given that it produced better returns over a period of time, the fund’s comparatively greater degree of risk within the category can be justified.

ICICI Prudential Equity & Debt Fund

ICICI Prudential Equity & Debt Fund has done well in both equity market rallies and downturns. However, its performance during market falls has been notable thanks to its prudent in-house asset allocation model based on the price-to-book metric. Over the last five years, equity allocation has been kept between 65 and 75 per cent.

The scheme’s low volatility has led to superior risk-adjusted returns when compared to those of peers over the long-term. One reason is that it invests more in high-quality large-cap stocks, helping to reduce the risk while generating better returns.

The scheme uses a blend of top-down and bottom-up approaches for stock selection. The fund managers prefer to follow the counter cyclical pattern in sector selection, contrarian style of investing and a bottom-up approach.

Quant Absolute Fund

Earlier known as Escorts Balanced Fund, the Quant Absolute Fund has been one of the top active funds within the category, both in terms of churning within the equity market capitalisation segments and also among the permitted asset classes. In contrast to four years ago, when the fund operated with a significant portfolio of mid-cap and small-cap stocks, its equity portion is now fully invested with large-caps.

Its equity portion is built with the quantitative approach based on the proprietary VLRT framework, that includes aspects related to the three axes of Valuation, Liquidity, and Risk appetite. On the debt side, the fund follows a low to moderate duration strategy that aims to generate income and minimise return volatility.

Performance as measured by the five-year rolling return calculated from the last 10-year data shows that the fund delivered a compounding annualised return of 17.6 per cent (top within the category), while the Nifty 50 – TRI posted 13.4 per cent. Meanwhile the aggressive hybrid fund category gave 12 per cent during the period.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.