I have bought one lot of Sun Pharmaceutical 1800-put option for ₹29.85. Also, I bought two lots of HUDCO 215-put option for an average price of ₹6.6. Both are January expiries. What should be my target and stop-loss for these positions? – Anish Das

Sun Pharmaceutical Industries (₹1,786.55): The stock, which has been on a decline since the beginning of this year, has now found support at ₹1,740.

Although Sun Pharma will carry some bearish bias until it trades below ₹1,830, the support at ₹1,740 might at least arrest the fall if not help in a recovery. But a rise to the nearest resistance at ₹1,830 is still possible.

If such a move occurs within a week from now, the premium of 1800-put can depreciate to approximately ₹12.

Given the current conditions, you can either exit the trade at the current level with a profit (as the premium is now at ₹34.15) or place a stop-loss at ₹10 and hold the trade for a week. Target can be ₹48.

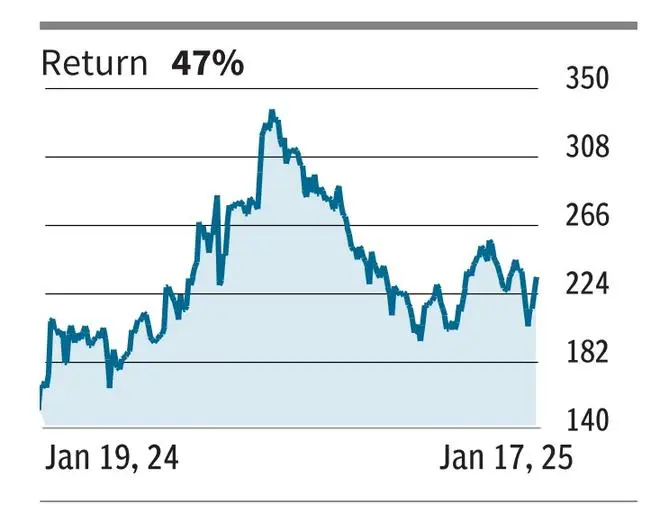

HUDCO (₹234.8): The stock bounced off the support at ₹200 last week. Currently trading at around ₹235, it faces a barrier at ₹250. Also, 240-strike call has seen a good amount of selling. Therefore, this is also a potential resistance.

That said, even if the fall resumes on the back of the resistance at ₹235, it might not lead to a breach of the support at ₹200 before the end of the current expiry.

However, if the resistance at ₹250 is breached, we can expect another leg of a rally, which can take the stock to ₹280 in the near-term. On the other hand, a break below ₹200 can lead to a fall to ₹170.

Considering the aforesaid factors, you may hold 215-put option, whose premium stood at ₹2.35 on Friday. But place a stop-loss at 0.90. In case the premium goes up, exit one lot at ₹8 and liquidate another lot at ₹12. So that the average exit price will be ₹10.

Send your queries to derivatives@thehindu.co.in

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.