Cola, the sugary beverage, has been one of the widely-sold commodities across globe for some good time now. And the cola wars, as fondly called, have always been the most innovative and never-ending. Now, with Campa Cola entering the fray in India (acquired by Reliance in CY22 and relaunched in CY23), making it a three-way battle with Pepsi and Coca-Cola, this space looks set for some good action.

Varun Beverages (VBL), PepsiCo’s largest bottler in India, contributing to around 90-plus per cent of PepsiCo India’s sales volume is the only listed and a prominent player in this space in India. However, Hindustan Coca-Cola Beverages (HCCB), Coca-Cola India’s bottler is gearing up for an IPO this year, with DRHP already filed in CY24.

Though well-placed for decent growth in the coming years, thanks to the recent acquisitions and sustained capex, VBL is trading at an elevated 55 times to its estimated CY25 earnings, despite the 20 per cent correction from its 52-week high in July 2024.

However, considering the solid fundamentals and track record of the company to show consistent growth, investors could consider holding on to VBL for now while waiting for further correction to find attractive entry points. Rising global temperatures and extended summers becoming more pronounced every year, also help the company’s case.

The business

The association with PepsiCo is 32-plus years old now and the ongoing agreement is valid till April 2039, signalling continuity. VBL’s overseas licenced territories include Sri Lanka, Nepal, Morocco, Zambia and Zimbabwe. Thanks to the recent acquisitions, this list goes deep into the African markets too. The relationship has been a win-win for both the parties, with PepsiCo looking after demand creation, in the form of trademarks and formulation through concentrate amidst others, while VBL has a keen eye and proven capabilities in sales and distribution, and focuses on delivering to the demand. To put it in simpler terms, VBL uses PepsiCo’s formulae and concentrates to manufacture and distribute beverages in the licenced territories. VBL, at present, has 34 manufacturing capacities spread across India and six in international territories.

Operating metrics

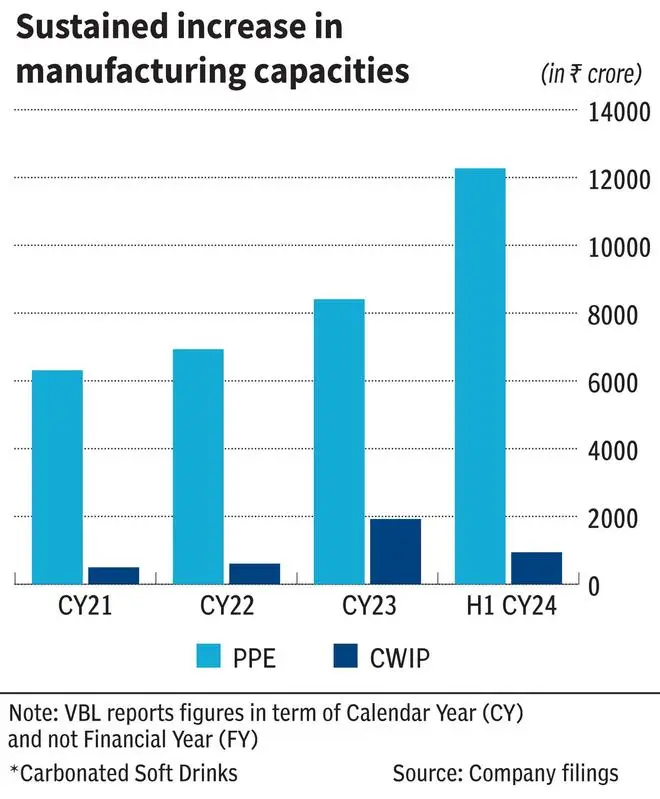

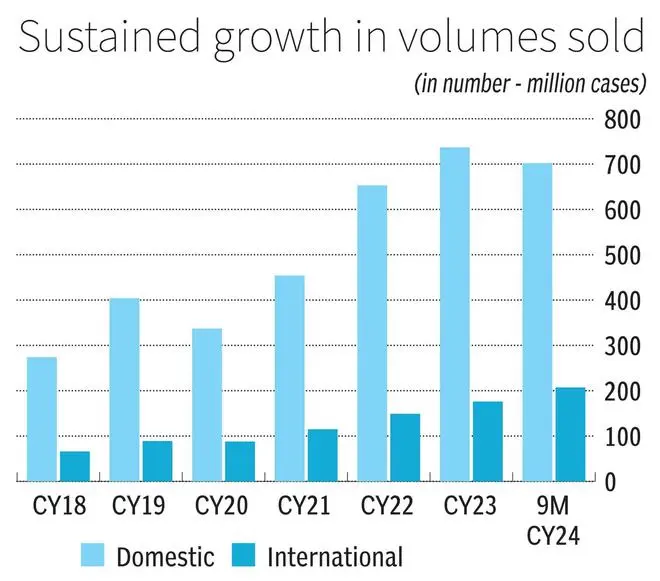

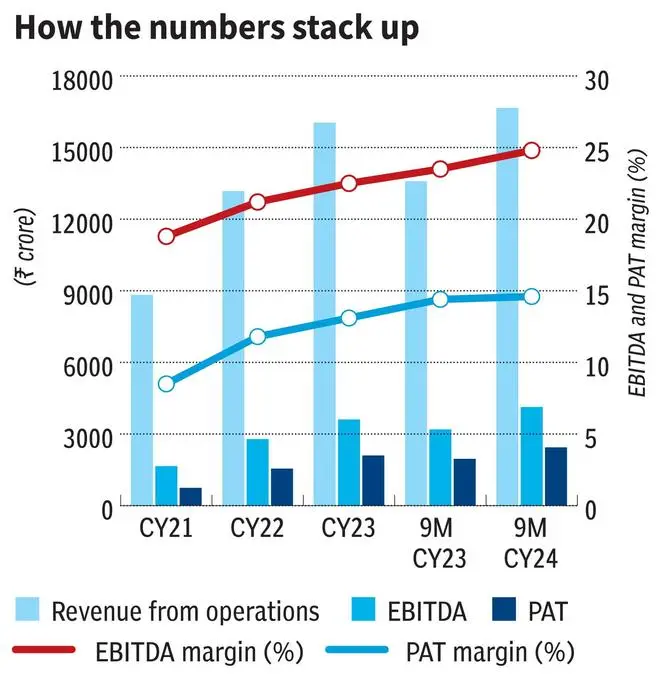

Volume sold in CY23 stood at 913 million cases with growth consistent at around 21.8 per cent CAGR since CY18 and a much faster 26.7 per cent CAGR since CY21. Revenue/ EBITDA/ PAT also grew at a strong CAGR of 34.8 per cent/ 47.7 per cent/ 67.8 per cent since CY21. Revenue, EBITDA and PAT stood at ₹16,043 crore, ₹3,610 crore and ₹2,102 crore respectively in CY23. However, the 9M-CY24 performance stood at ₹16,664 crore, ₹4,131 crore and ₹2,439 respectively, already surpassing the entire CY23 numbers, and bettering the comparable previous year figures by 22.6 per cent, 29.5 per cent and 24.5 per cent respectively. While India still contributes to around three quarters of the topline, VBL has made significant strides in the overseas markets recently.

Revenue growth was supported by an increasing retail outlet distribution network from around 2 million retail outlets in CY20 to 3.8 in CY23 helping with penetration. Acquiring more licenced territories also helped in volume growth.

Operating margin has improved from 22 per cent in CY22 to 23 per cent in CY23. The same is at 25 per cent for 9M-CY24. Margins were aided by operational efficiencies from backward integration measures such as in-house manufacturing of preforms and light-weighting of packaging. VBL’s portfolio of low-/ no-sugar products have consistently increased and is at 49 per cent of the entire portfolio for 9M-CY24 against 35.7 per cent in CY22, which also played its part.

The ‘Sting’ effect

Sting is VBL’s latest addition (in 2020) to its energy/ sports drink portfolio. Priced affordably, Sting,when it was launched, gained quick ground as there was no other player priced competitively and Red Bull and Monster - the then leading players, were priced at 2x that of Sting. And consequently, Sting’s share in volumes sold by VBL increased strongly from 9.6 per cent in CY22 to 15 per cent in H1 CY24. Moreover, it earned the best profit margins amidst other products in PepsiCo’s stable, helping both the topline and bottomline, as observed from the consistent increase in realisation per case sold, from ₹164 in CY22 to ₹179.8 as of Q3 CY24.

Focus on international business

VBL acquired The Beverage Company (BevCo) in March 2024. BevCo is PepsiCo’s bottler in South Africa (including Lesotho and Eswatini) and Democratic Republic of Congo (DRC). BevCo also possesses distribution rights for Namibia and Botswana. In November 2024, two more acquisitions added Ghana and Tanzania to the list, subject to pending regulatory approvals.

With most of the above acquisitions fuelled by debt, VBL’s net debt to equity jumped to 0.67 times as of H1 CY24, with debt at almost ₹6,000 crore at its peak. Finance costs, too, were up 88 per cent in H1 CY24 against H1 CY23. However, the company has this under control post the recent fund raise of ₹7,500 crore via QIP in December 2024 at ₹565 per share, to fund expansion and for debt reduction. It is likely to have a net cash position now, post-QIP.

Apart from the agreement for beverages, VBL also won rights to manufacture and distribute snacks in CY24, which began with Morocco and later extended to Zimbabwe and Zambia.

Key monitorables

PepsiCo derives around 50 per cent of its topline from snacks. And with the exclusive agreement to manufacture and distribute snacks in select territories, VBL is the first and only franchisee of PepsiCo yet, to have won rights pertaining to snacks, which were housed only within PepsiCo until now. Snacks are touted to have a relatively-better margin profile than beverages, and more rights won in this space could result in another revenue vertical for VBL. Execution will remain a key monitorable here, as always.

PepsiCo’s Sting took the energy drink segment by storm with its competitive pricing and effective advertising. And now, the space has Coca-Cola’s Charged and Campa Cola’s Campa Energy, both launched in 2024. How the energy drink segment performs for VBL and the product mix, going forward, will be a key monitorable.

The focus on international markets, predominantly where Coca Cola leads with market share, brings in some execution and operating risks, however it has also been a tried-and-tested expansion route. VBL’s track record in this regard is good and this also slightly soothes the historically-cyclical business as summers and winters are exactly in opposite quarters for African countries, especially South Africa and Tanzania, and the Indian subcontinents. While it is not big enough to offset and positively impact the leaner season in India, it is still a tilt in the right direction.

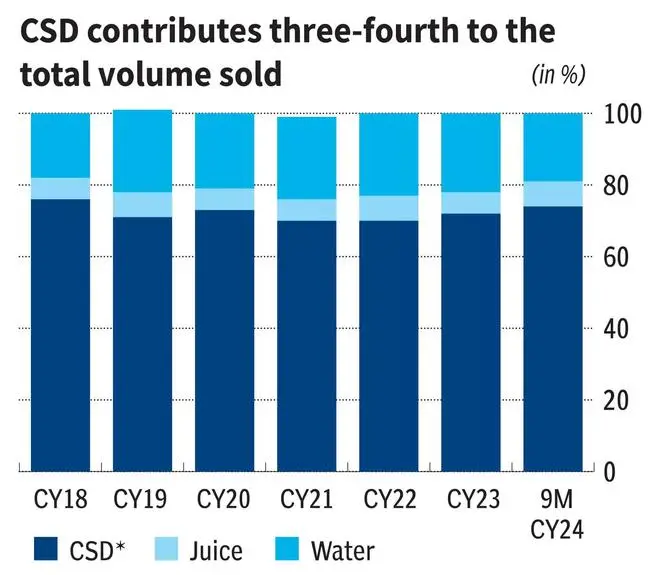

Increasing awareness on sugar intake and focus on healthier and fresher alternatives are structural theses operating against VBL and will be key monitorables. While carbonated soft drinks (CSD) contribute around 75 per cent in volume for VBL, the transition to low-/ no-sugar products will be crucial. The possibility of GST hike also continues to be an overhang; it is not a stock-specific concern, but rather prevalent industry-wide.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.