The equity sector mutual fund schemes that bet primarily on the pharmaceutical and healthcare stocks have fared well over the last two years, following a disappointing performance in 2022. In 2024, it was the top performing category among the sector and thematic funds. The category delivered 30 per cent for the one-year ended January 17, 2025, while the broader index Nifty 50 total return index (TRI) posted nine per cent.

HDFC Pharma and Healthcare, ICICI Pru Pharma Healthcare & Diagnostics (P.H.D) and DSP Healthcare topped the chart and delivered an absolute return of 40 per cent, 37 per cent and 34 per cent, respectively, over the past year.

The strong performance of pharma stocks in the past 1-2 years can be attributed to several key drivers that include notable domestic growth, international expansion, innovation in high-margin products, and improved cost management.

Nirav Karkera, Head of Research at Fisdom said, “Domestically, revenue growth was spurred by price increases, new product launches, and consistent demand for therapies in chronic segments like cardiac, gastro, anti-diabetic, and derma”.

Globally, regulatory approvals in key markets like the US and Europe, along with the ramp-up of newly established facilities, contributed to revenue. “US sales growth was driven by niche and specialty product launches and easing price erosion in generics, which boosted profitability. The focus on complex generics, biosimilars, and custom synthesis segments has created a sustainable growth pathway to the domestic pharma players Karkera added.

Multibagger returns

Funds that allocated higher exposure to mid and smallcap pharma and healthcare companies delivered higher returns versus the peers. Within the category, active schemes that held significant allocation to mid and small-cap stocks include Quant Healthcare (84 per cent), ITI Pharma & Healthcare (69 per cent) and UTI Healthcare (68 per cent).

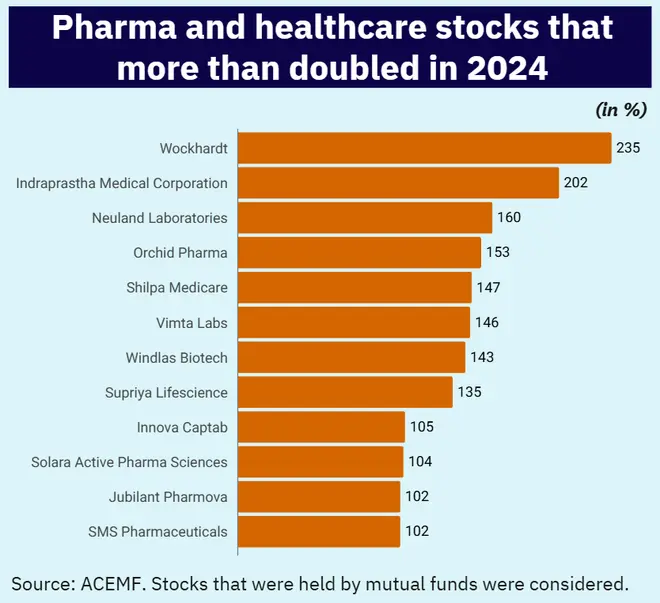

Twelve pharma stocks more than doubled in 2024. Top stocks that contributed to the performance of the schemes include Wockhardt (gained 235 per cent in 2024), Indraprastha Medical Corporation (202 per cent) and Neuland Laboratories (160 per cent).

Multibagger pharma stocks

Going ahead, the outlook for the pharmaceutical sector is expected to be stock-specific, emphasising a bottom-up approach rather than broad-based index performance, believed Karkera. Growth will be concentrated in companies leveraging niche capabilities such as specialty products, biosimilars, and complex generics, with a focus on expanding their presence in regulated markets like the US and Europe. Players with robust pipelines, strong R&D focus, and competitive cost structures are likely to outperform, Karkera added.

Kamal Gada, Fund Manager, UTI AMC said, “the absolute and relative valuations of pharma and healthcare sectors have moved higher, but given earnings growth trajectory as well as strong balance sheets, the valuations do not look stretched. Also, valuations remain cheaper than other consumer-oriented growth sectors with similar growth profile”.

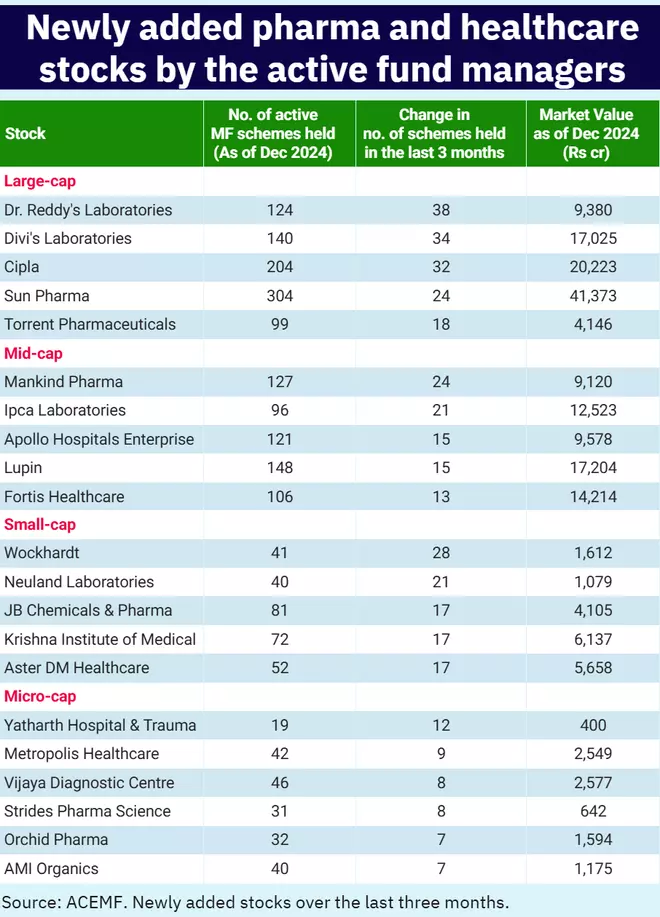

Here are the top healthcare services players that were newly added by the actively managed equity oriented mutual funds schemes over the last three months. There were 669 active equity schemes which were considered for the study. Portfolio data were as of December 31, 2024. Source: ACEMF.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.