The Economic Survey has projected the gold prices to decline on the back of expected fall in inflation and silver prices to gain in the coming fiscal on back of industrial demand.

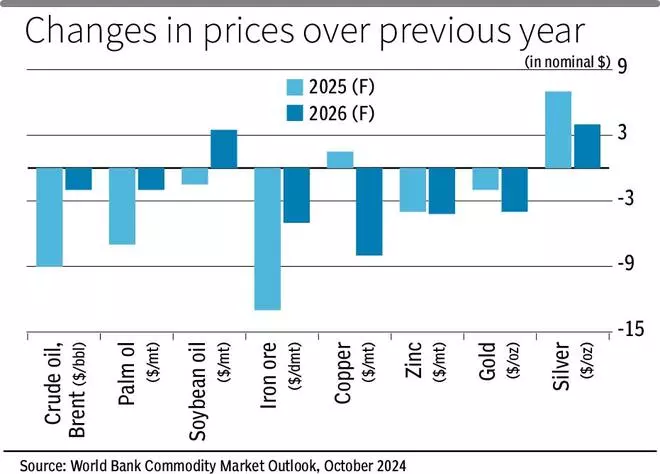

Based on the World Bank’s Commodity Markets Outlook released last October, the Economic Survey expects commodity prices to decrease by 5 per cent in 2025 and 2 per cent in 2026.

The projected declines will be led by oil prices but tempered by price increases for natural gas and a stable outlook for metals and agricultural raw materials, it said.

- Also read: Economic Survey 2025 Highlights

Among precious metals, gold prices are expected to decrease while silver prices are will increase. Prices for metals and minerals are expected to decline, primarily due to a decrease in iron ore and zinc prices.

In general, the downward trend movement in the prices of commodities imported by India is a positive for the domestic inflation outlook, said the survey ahead of the Union Budget to be released on Saturday.

Colin Shah, MD, Kama Jewelry, said the possibility of inflation easing out in March quarter supported by easing inflation brings in a relief for gold prices.

However, he said geopolitical tensions continue to be a major deterrent, disrupting the fund flows. In terms of trade, the outlook will largely be dependent on geopolitical tensions, trade tariffs, Dollar index.

Shah expects gold prices to stay elevated due to uncertainties and lower rates, he added.

Meanwhile, the bullion industry is expecting the Budget to reduce the import duty on gold to 3 per cent from 6 per cent currently.

Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities, said gold traded with a premium of ₹250 even as the Comex remained flat on expectation of potential cut import duty. If no changes occur, the premium may reduce on Budget day and expected range for gold is ₹80,500-₹83,000 per 10 grams, excluding any duty-related adjustments, he added.

Sachin Jain, Regional CEO, India, World Gold Council, said the gold industry contributes 1.3 per cent to India’s GDP and employs about 2-3 million people.

The reduction in taxes on gold last July has led to a more organised and transparent industry, resulting in a stronger gold market. However, any increase in import duties in upcoming Budget may have adverse effects, potentially leading to an increase in smuggling, higher domestic gold prices and pushing the industry backwards, he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.